Superannuation Reforms

The treasurer & financial services minister have confirmed that from 1 November 2021, where an employee has an existing superannuation

account, that account will be “stapled” and follow them when they change jobs.

What is this, and what does it mean?

Every year around 850,000 duplicate superannuation accounts are created. Each time this means

- unnecessary / duplicated fees,

- an increased potential of lost super, and

- your super may not be working as well for you in separate accounts compared with if they were combined.

In an effort to reduce this (and have an end goal of maximizing retirement incomes), these new reforms are simply a change to what happens if an employee does not nominate a Superannuation Fund on their Superannuation Standard choice form.

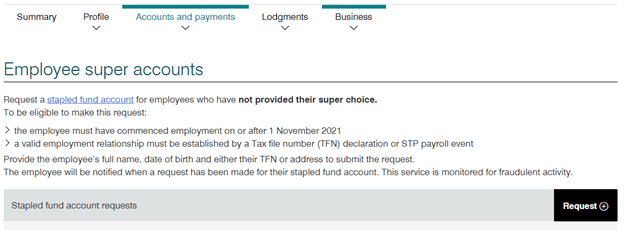

What’s new for Employers

Before you can go ahead and create an Employer Nominated Superfund Account for the employee, you must first check if the employee has a

“stapled” superfund. You can do this by submitting a request via the ATO Business Portal / ATO Tax Agents Portal (located under

the "Business" drop down menu

The employee information required to complete the request is:

- Surname

- Given Name

- Tax File Number

- Date of Birth

- Employee address (either residential or postal)

The ATO will then process your request and respond with details of the superfund you are to use for this employee (this will be their

“stapled” super fund).

If the ATO reply advising there is no stapled superfund for an employee, then you can go ahead and create an employer nominated fund for that employee.

What stays the same

It is important to note that this service can take a few days to receive a response from the ATO. There are no changes (& no

exceptions) to the rules for the cut-off dates for Super.

SGC must be received & cleared into the employees’ superfund no later than 28 days after the end of a quarter, so remember to

allow for

- ATO processing times to get stapled superfund information

- The usual transfer times from funds leaving your bank account and being received into the employee superfund.

Should you have any questions, please contact your account manager directly.