Payroll Housekeeping Tips 2020

For many employers – this will be the first time preparing Income Statements (formerly known as Payment Summaries – or for us older ones – Group Certificates) under Single Touch Payroll (STP).

If up until now you have been struggling to find the benefits of STP – THIS

will be the defining moment, and we expect that we will hear you audibly cheering at how easy the payroll finalisation process will be this

year (especially those that remember the days of painstakingly hand filling out individual forms).

In future blogs I will advise on the finalization process as well as roll over procedures and year end jobkeeper issues + other tips

In the lead up to 30 June 2020, we recommend that you take a moment now to do a quick review of your employees and make sure that anyone who has ended their employment or been terminated have had those details updated in your payroll software.

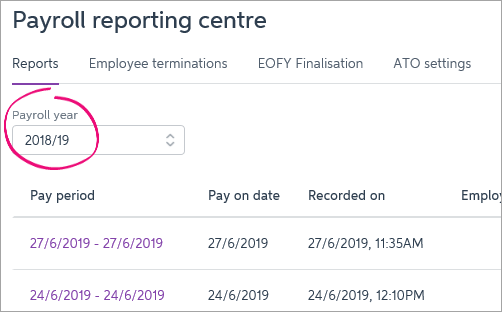

For MYOB Users, you will find a tab in the Payroll Reporting Centre called “Employee terminations”. This will give you a list of your employees.

Looking specifically at employees who are no longer employed by you, check to see if there is a termination date associated next to their name.

If not, simply tick the employee > enter the date that their employment ended > and then select Notify the ATO. This is then

submitted the same way as you submit a payrun. This lets the ATO know not to expect any further payments from you for this employee, and

should also prefill dates on the Income Statement for you. Just remember to check that you are in the current payroll year.

If not, simply tick the employee > enter the date that their employment ended > and then select Notify the ATO. This is then

submitted the same way as you submit a payrun. This lets the ATO know not to expect any further payments from you for this employee, and

should also prefill dates on the Income Statement for you. Just remember to check that you are in the current payroll year.

For MYOB AccountRight subscribers. If you haven’t already upgraded your MYOB

file to 2020.2 – we highly recommend you do it now. (You may have heard that MYOB experienced some glitches early in its release, but that

has all been rectified now).

There are some great new features with this latest version, including (drumroll please…..) you will no longer need to close and roll

forward a payroll year

at the end of the financial year. This is hands down my personal favourite.

Xero has a slightly different approach, as they allow for you to process the last pay run for an employee with the click of “Set as Final

Pay” at the time of preparing the termination pay. However, it is easy to miss this for a casual employee (as you are not paying out leave

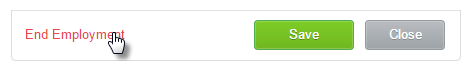

entitlements etc). So if you have missed this step, you can select employees in the payroll menu > Select the employee > then select

the employment tab. From there click End Employment, and select the last working day.

Syarna's Pro Tip

(Great tip - thanks Syarna!)

It is also worthwhile to check each employee card file to ensure you have the correct Tax File Number recorded, and all mandatory fields completed. For MYOB in particular this includes Employee Address, Contact Number and Email Address.

Kind regards

Allison Gigl